The Growth of FAST Channels in Canada

Written By: Jo Loup, Content Marketing Specialist at NLogic (full article can be read here)

The TV landscape is constantly changing. In recent years we've seen a strong focus on subscription viewing services with the rise of Netflix and Amazon Prime Video. However, as people become tired of paying for multiple subscriptions, they are increasingly interested in free streaming services like FAST channels.

According to Digital TV Research, FAST (Free-Ad Supported Television) revenue is projected to reach $16.5 billion in 2029, up 117% from $7.6 billion in 2023. Admittedly, the vast majority of this revenue comes from the US market at the moment, where almost 2,000 FAST channels are provided across 22 networks.

What is FAST TV?

The essence of FAST channels lies in their cost-free and ad-supported model. They provide both on-demand and live-streaming services delivered over the internet. Recent research from Rogers shows that Canadians are becoming more accepting of seeing ads in their streaming services. Two-thirds of respondents agreed they would be willing to see ads if the content was free.

The live streaming element of these FAST services sets them apart from other AVOD services such as ad-supported Netflix, Discovery Plus and YouTube. These platforms are fully on-demand whereas FAST channels can also offer a curated schedule.

This gives viewers the lean-back experience that was always seen as an important part of traditional viewing. As viewers are faced with an ever-growing range of content options this may be seen as a more attractive proposition.

Users can also easily access these services on websites or connected TV apps without needing to create an account first.

In Canada, there are not as many FAST TV channels as in the US, but the number is increasing quickly. Pluto TV, Roku, CBC, TubiTV and Samsung TV Plus currently offer over 400 channels. These can contain programming from broad genres such as crime, comedy, and reality to whole channels devoted to popular shows such as Wipeout, Top Gear and CSI.

The FAST Channel Audience

Here in Canada, we are fortunate to have access to both the Numeris Cross-Platform Video Audience (VAM) dataset and the MTM survey1. These both give us insights into the audience growth and profile of various streaming services in Canada.

The VAM data allows us to analyze the viewers of Pluto TV, Roku Channel, TubiTV and Samsung TV Plus. This dataset includes both on-demand and live-streaming elements.

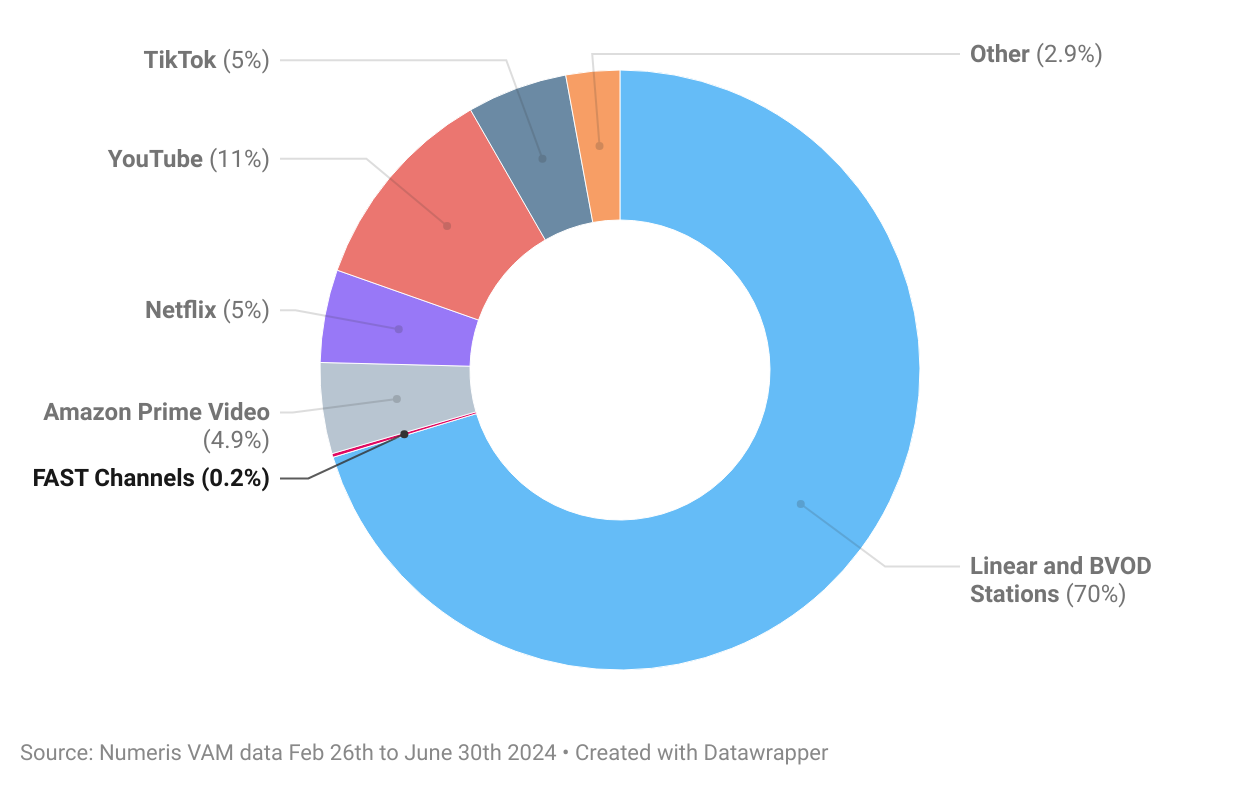

First, it's important to understand how these channels are viewed in the context of all video consumption. By using InstarVAM 2 we analyzed the VAM data from February 26th to June 30th, 2024.

We can see that Linear and BVOD viewing is still important and makes up just over 70% of all viewing in the reported markets of Ontario and Quebec Franco. (Our previous blog on the importance of linear TV examines this in more detail.)

Share of Total Viewing

When we remove the linear channels and analyze streaming only, the combined share of the four FAST channels listed above accounts for 0.7%.

Although the share of viewing to these stations is very small, it appears that they are generating interest with Canadian viewers. Over the past 6 months, 5.5m Canadians in the reported markets have watched at least one minute across the three services. This represents almost 25% of the Total Sample. This figure rises to almost 30% if we only look at the viewing in the Ontario market.

The latest MTM survey also gives some insights into the viewers of FAST channels. The Spring 2024 survey shows that 20% of Canadian adults claim to have watched any FAST content in the past month (up from 16% in the 2023 Spring survey).

FAST channels are more popular among anglophones than francophones. 22% of anglophones watched FAST channels, compared to 12% of francophones. There is also more interest in northern regions, where 36% claim to have watched in the past month.

It appears that FAST services are supplementing rather than replacing other video services. 85% of FAST viewers already subscribe to an SVOD service with half of this group subscribing to 3 or more services.

However, given that they are free to access it is no surprise that FAST services index higher amongst Canadian adults who access their TV content through an antenna. 17% of FAST viewers belong to this group whereas this group is only 7% of the population.

The Importance to Advertisers

Firstly, the niche nature of the content on these channels allows for highly targeted advertising and integration opportunities.

Also, FAST channels have the potential to experiment with fresh advertising formats. Interactive elements such as adding a QR code to the ad allow viewers to request more information about products and services. According to a recent report from LG Ad Solutions, these interactive features are proving extremely popular with 71% of CTV users liking ads that include a QR code.

In addition to this, the shorter ad slots mean that ads have more chance to stand out in a less cluttered environment

When planning cross-platform video campaigns advertisers and media strategists can leverage the Numeris VAM dataset through our newly introduced Video Planner. This innovative tool offers users the opportunity to delve into the additional reach potential that these FAST channels can bring to their video advertising campaigns.

The emergence of FAST channels signifies yet another shift in the way audiences consume video, as well as how advertisers connect with viewers. Although they are still in the early stages here in Canada, it will be interesting to monitor their progress using the datasets available to us.

1. The Media Technology Monitor (MTM) is Canada’s leading survey in technology ownership and use containing a wealth of information on audio and video streaming habits.

2. InstarVAM is our hosted application which allows users to analyze both linear and digital video content across all platforms.